Do i have to pay Council Tax? - NO!

Time to beat the ROTTEN, CORPORATE, FRAUDULENT, CRIMINAL councils, CRIMINAL corporate courts, CRIMINAL bailiffs and debt collection companies, CRIMINAL corporate police forcing entry on behalf of the FRAUDULENT claims, and beat them at their own game!

http://qnet.me/do-I-have-to-pay-council-tax/

When enough people STOP PAYING Council Tax & Business Rates then the huge lumbering corporate SCAM will collapse!

Council Tax is a renewable yearly contract, requiring signatures of both parties & full disclosure. There is NO lawful requirement to pay. CT is administered by private-for-profit corporations, primarily for paying their golden pensions & interest on debts! 30% or less goes to public services! Councils hire private courts & issue their own summons. Time to expose the FRAUD & demand a new system!

Saturday 14 November 2015

Wednesday 11 November 2015

Corporate council chiefs asset-stripping & robbing the Public

It's a fact! Large numbers of council CEOs and managers are walking away with VAST sums stolen from Public Funds. All of this sordid story is evidence of CRIME, yet the police, judiciary and government refuse to anything about it!

http://www.dailymail.co.uk/news/article-3309596/The-shocking-scale-fat-cat-pay-public-sector-exposed-today-major-Daily-Mail-investigation.html

Whilst MILLIONS of pounds of Britain's Public Funds are syphoned-off for personal and private gain and Britain is subject to welfare cuts and other "austerity", there are THIEVES in councils, the NHS, the police, Social Services and government who are literally getting away with FRAUD & CRIME on a massive scale.

ANYONE paying the FRAUD of Council Tax or Business Rates to the CRIMINAL corporations is willingly or unwillingly complicit in their crimes!

http://www.dailymail.co.uk/news/article-3309596/The-shocking-scale-fat-cat-pay-public-sector-exposed-today-major-Daily-Mail-investigation.html

Whilst MILLIONS of pounds of Britain's Public Funds are syphoned-off for personal and private gain and Britain is subject to welfare cuts and other "austerity", there are THIEVES in councils, the NHS, the police, Social Services and government who are literally getting away with FRAUD & CRIME on a massive scale.

ANYONE paying the FRAUD of Council Tax or Business Rates to the CRIMINAL corporations is willingly or unwillingly complicit in their crimes!

Saturday 10 October 2015

Council Tax funds wars and terrorism - time to take a stand!

The story of Chris Coverdale and his stand against the war and terrorism-supporting Council Tax:

http://www.hastingsobserver.co.uk/news/crime/sussex-man-refuses-to-pay-council-tax-on-terrorism-beliefs-1-6998642

http://www.makewarshistory.co.uk/?p=1497

The collection of Council Tax by private-for-profit corporations, to fund terrorism and illegal wars, without the approval of Parliament and against ratified International Law. is a CRIME BY DEFINITION!

Not only that, but the ENTIRE Council Tax SCAM is a PROVEN FRAUD because ALL councils have "unuseable reserves" of TENS OF MILLIONS OF POUNDS that they are hiding from their inhabitants, "reserves" that can easily prevent ANY cuts in Public Services and could reduce the need to collect local taxes at all!

http://www.hastingsobserver.co.uk/news/crime/sussex-man-refuses-to-pay-council-tax-on-terrorism-beliefs-1-6998642

http://www.makewarshistory.co.uk/?p=1497

The collection of Council Tax by private-for-profit corporations, to fund terrorism and illegal wars, without the approval of Parliament and against ratified International Law. is a CRIME BY DEFINITION!

Not only that, but the ENTIRE Council Tax SCAM is a PROVEN FRAUD because ALL councils have "unuseable reserves" of TENS OF MILLIONS OF POUNDS that they are hiding from their inhabitants, "reserves" that can easily prevent ANY cuts in Public Services and could reduce the need to collect local taxes at all!

A few questions for your local council

A few questions you may wish to ask your local council in relation to council tax:

1. What factually is a borough or a county?

2. Are there any witness with first hand personal knowledge, that I am a taxpayer and have an obligation to pay council tax….? Please answer yes or no

3. Is there any admissible evidence that I am a taxpayer and have an obligation to pay council tax….? Please answer yes or no

4. Are the opinions that I am a taxpayer and have an obligation to pay council tax irrefutable? Please answer yes or no.

5. Does such an obligation should it factually exist, require my voluntary cooperation? Please answer yes or no.

6. Can you provide me with evidence that the Local Government Finance Act applies to me? Please answer yes or no.

7. Can you provide me with a factual time to show how, why, where and when the alleged obligation was created. Please answer yes or no.

8. On the occasions when the council take people to court over failing to pay council tax, do you present valid cause of action to any competent court of law that has jurisdiction? Please answer yes or no.

9. Is there ever any legally admissible evidence to prove such an alleged obligation? Please answer yes or no.

10. Is the complaint in the nature of a contract? Please answer yes or no.

11. Is the complaint in the nature of a tort? Please answer yes or no.

12. Would the alleged complaint/claim be factually consistent with the Human Right Act 1998? Please answer yes or no.

13. When making a complaint for non-payment of council tax, does the authorised officer make a legal determination that everyone has the obligation or has a liability to pay council tax? Please answer yes or no.

14. Are the agents that make the determination that everyone is liable to pay council tax, qualified to make legal determinations? Please answer yes or no.

15. Does the council have the permission of the Attorney General to prosecute for non payment of council tax? Please answer yes or no.

1. What factually is a borough or a county?

2. Are there any witness with first hand personal knowledge, that I am a taxpayer and have an obligation to pay council tax….? Please answer yes or no

3. Is there any admissible evidence that I am a taxpayer and have an obligation to pay council tax….? Please answer yes or no

4. Are the opinions that I am a taxpayer and have an obligation to pay council tax irrefutable? Please answer yes or no.

5. Does such an obligation should it factually exist, require my voluntary cooperation? Please answer yes or no.

6. Can you provide me with evidence that the Local Government Finance Act applies to me? Please answer yes or no.

7. Can you provide me with a factual time to show how, why, where and when the alleged obligation was created. Please answer yes or no.

8. On the occasions when the council take people to court over failing to pay council tax, do you present valid cause of action to any competent court of law that has jurisdiction? Please answer yes or no.

9. Is there ever any legally admissible evidence to prove such an alleged obligation? Please answer yes or no.

10. Is the complaint in the nature of a contract? Please answer yes or no.

11. Is the complaint in the nature of a tort? Please answer yes or no.

12. Would the alleged complaint/claim be factually consistent with the Human Right Act 1998? Please answer yes or no.

13. When making a complaint for non-payment of council tax, does the authorised officer make a legal determination that everyone has the obligation or has a liability to pay council tax? Please answer yes or no.

14. Are the agents that make the determination that everyone is liable to pay council tax, qualified to make legal determinations? Please answer yes or no.

15. Does the council have the permission of the Attorney General to prosecute for non payment of council tax? Please answer yes or no.

Tuesday 15 September 2015

Council 'Social Services' are directly involved in CHILD ABUSE!

Regardless of political affiliation, councils around the country are run by private-for-profit corporations. The 'contracts' to run the councils were agreed by members of ALL political parties!

One group of private companies in local councils are known as 'Social Services'. They have been stealing children for their private profits, working together with the secret Family Courts and Police, to access the private accounts created by the Registration of Live Birth of children by their parents. Every year 20,000 children go missing in Britain. Every year over a thousand young children go missing from council-run care homes. MOST of these children are NEVER seen again. They disappear because they are murdered and buried in unmarked graves or bodies destroyed. They are murdered because they are witnesses to the paedophile rings being run by politicians, judges, lawyers Social Services members, police, priests, by Masonic groups, by international groups, etc.

ALL councils have been involved in this abuse and fraud for decades. Not all council staff are involved, but many are involved in covering-up the abuse and protecting the paedophiles.

Enough is enough!

https://www.youtube.com/watch?v=YE4lBKkdm68

https://www.youtube.com/watch?v=qs5CruvCRmA

It is time to STOP PAYING Council Tax to the CRIMINAL & FRAUDULENT councils, and demand that they do their jobs and Serve The Public!

One group of private companies in local councils are known as 'Social Services'. They have been stealing children for their private profits, working together with the secret Family Courts and Police, to access the private accounts created by the Registration of Live Birth of children by their parents. Every year 20,000 children go missing in Britain. Every year over a thousand young children go missing from council-run care homes. MOST of these children are NEVER seen again. They disappear because they are murdered and buried in unmarked graves or bodies destroyed. They are murdered because they are witnesses to the paedophile rings being run by politicians, judges, lawyers Social Services members, police, priests, by Masonic groups, by international groups, etc.

ALL councils have been involved in this abuse and fraud for decades. Not all council staff are involved, but many are involved in covering-up the abuse and protecting the paedophiles.

Enough is enough!

https://www.youtube.com/watch?v=YE4lBKkdm68

https://www.youtube.com/watch?v=qs5CruvCRmA

It is time to STOP PAYING Council Tax to the CRIMINAL & FRAUDULENT councils, and demand that they do their jobs and Serve The Public!

Wednesday 12 August 2015

Is YOUR council investing in ILLEGAL munitions?

Wesley Ahmed:

"ASK YOUR COUNCIL THIS "APPLICATION FOR DISCOUNT UNDER SECTION 13a LOCAL GOVERNMENT FINANCE ACT 1992" and all you ask if you end up in court is that the council can assure you that the monies going to the council does not go on funding terrorism

thats what you call a legal cluster bomb going off inside your council

they use paper and pen terrorism to collect your money

they use your money to fund terrorism

they are hiding Trillions of your money in reserved bank accounts ask your council how much do they have in reserves

they pay £3 for a summons and charge you between £75.00 to £100 pound which is another money making racket and another license for them the council to print more money

if you dont believe me watch this

your government is the council who fund terrorism on a daily basis

you are more likely to be killed by your own government and corporate entity's than you are a terrorist shite they spewout in their propaganda bullshit

Tie them up in their own bullshit"

https://www.youtube.com/watch?v=JoRugRu3ijk

It is time to STOP PAYING Council Tax to the FRAUDULENT & CRIMINAL corporate councils!

EXPOSE THEIR CRIMES, STOP PAYING & SACK THEM!

"ASK YOUR COUNCIL THIS "APPLICATION FOR DISCOUNT UNDER SECTION 13a LOCAL GOVERNMENT FINANCE ACT 1992" and all you ask if you end up in court is that the council can assure you that the monies going to the council does not go on funding terrorism

thats what you call a legal cluster bomb going off inside your council

they use paper and pen terrorism to collect your money

they use your money to fund terrorism

they are hiding Trillions of your money in reserved bank accounts ask your council how much do they have in reserves

they pay £3 for a summons and charge you between £75.00 to £100 pound which is another money making racket and another license for them the council to print more money

if you dont believe me watch this

your government is the council who fund terrorism on a daily basis

you are more likely to be killed by your own government and corporate entity's than you are a terrorist shite they spewout in their propaganda bullshit

Tie them up in their own bullshit"

https://www.youtube.com/watch?v=JoRugRu3ijk

It is time to STOP PAYING Council Tax to the FRAUDULENT & CRIMINAL corporate councils!

EXPOSE THEIR CRIMES, STOP PAYING & SACK THEM!

Tuesday 14 July 2015

Wigan MBC - ANOTHER 'rotten borough'!

Is it "Wigan Metropolitan Borough Council" or "Wigan Council"? Which is it?

Which one has the crest and 'official status' and which one is a PRIVATE-FOR-PROFIT company trading FRAUDULENTLY and Misappropriating Public Funds?

Which employees of Wigan MBC/Wigan Council are involved and committing the serious CRIMINAL offence of Misconduct/Malfeasance in Public Office and should all be prosecuted and imprisoned after their assets (proceeds of crime) are confiscated?

Do Wigan Social Services know about the Wigan 'council' CRIMINALS involved, and, if so, will they want to step-in and take their children into care to prevent any possible future harm that might arise from the investigations and prosecutions?

http://www.wigantoday.net/news/local/council-in-multiple-identities-row-1-7201527

Wigan inhabitants may wish to withhold their Council Tax payments until this CRIMINAL matter is properly investigated!

Which one has the crest and 'official status' and which one is a PRIVATE-FOR-PROFIT company trading FRAUDULENTLY and Misappropriating Public Funds?

Which employees of Wigan MBC/Wigan Council are involved and committing the serious CRIMINAL offence of Misconduct/Malfeasance in Public Office and should all be prosecuted and imprisoned after their assets (proceeds of crime) are confiscated?

Do Wigan Social Services know about the Wigan 'council' CRIMINALS involved, and, if so, will they want to step-in and take their children into care to prevent any possible future harm that might arise from the investigations and prosecutions?

http://www.wigantoday.net/news/local/council-in-multiple-identities-row-1-7201527

Wigan inhabitants may wish to withhold their Council Tax payments until this CRIMINAL matter is properly investigated!

Saturday 11 July 2015

Bournemouth Borough Council - A TRULY 'rotten borough'!

When a councillor challenges the legality of the budget he is told to "shut up"!

http://www.bournemouthecho.co.uk/news/11567130.___Put_up_or_shut_up________leader___s_message_to_councillor_after_legality_of_budget_and_council_tax_questioned/

The heads of councils ALL know that MASSIVE FRAUD is being committed! Many of their management know too! ALL the Chief Financial Officers are DIRECTLY involved in FRAUD!

Time to STOP PAYING the FRAUD of Council Tax!

http://www.bournemouthecho.co.uk/news/11567130.___Put_up_or_shut_up________leader___s_message_to_councillor_after_legality_of_budget_and_council_tax_questioned/

The heads of councils ALL know that MASSIVE FRAUD is being committed! Many of their management know too! ALL the Chief Financial Officers are DIRECTLY involved in FRAUD!

Time to STOP PAYING the FRAUD of Council Tax!

Who is YOUR council?

The heads of most councils are LIARS & FRAUDS!

They are STEALING from the inhabitants!

They know exactly what they are doing!

They are DELIBERATELY asset-stripping Britain!

https://www.youtube.com/watch?v=asL5ia35dg8

It is time to STOP PAYING the ROTTEN FRAUD of Council Tax!

They are STEALING from the inhabitants!

They know exactly what they are doing!

They are DELIBERATELY asset-stripping Britain!

https://www.youtube.com/watch?v=asL5ia35dg8

It is time to STOP PAYING the ROTTEN FRAUD of Council Tax!

How Councils Blow Your Millions

How councils blow your millions!

Despite VAST "reserves" councils have been borrowing money and forcing inhabitants to pay the interest!

http://www.channel4.com/programmes/dispatches/articles/all/how-councils-blow-your-millions

This is yet another simple case of FRAUD by the ROTTEN & CORRUPT corporate councils across Britain and the rest of the UK!

Time to STOP paying the CORPORATE FRAUD of Council Tax!

Despite VAST "reserves" councils have been borrowing money and forcing inhabitants to pay the interest!

http://www.channel4.com/programmes/dispatches/articles/all/how-councils-blow-your-millions

This is yet another simple case of FRAUD by the ROTTEN & CORRUPT corporate councils across Britain and the rest of the UK!

Time to STOP paying the CORPORATE FRAUD of Council Tax!

Thursday 9 July 2015

Councils get cash to fund more child stealing

While the FRAUD of "austerity" goes on impacting negatively upon local Public Services, councils are being given even more money to spend on STEALING children for CASH!

http://www.theguardian.com/society/2015/jul/05/councils-30m-fund-speed-up-adoption-searches

Forced Adoption is a CRIME!

Social Services (in each area) are private-for-profit registered companies, trading for PROFIT and working according to 'targets'!

Council Taxes are being used for funding FRAUD!

http://www.theguardian.com/society/2015/jul/05/councils-30m-fund-speed-up-adoption-searches

Forced Adoption is a CRIME!

Social Services (in each area) are private-for-profit registered companies, trading for PROFIT and working according to 'targets'!

Council Taxes are being used for funding FRAUD!

Council Tax is FRAUD - Section 151 officers & fraudulent accounting

Council Tax is a FRAUD of epic proportions.

EVERY council has huge sums in "investments", sums which are more than enough to negate the need for ANY payment of Council Tax and ANY need for cuts in services. This has been clearly established by investigations into the council financial reports and the fact that council Chief Financial Officers have been caught lying about the "reserves". Secrecy and Lies have been the 'normal practice' in ALL councils, especially since council administration was sold-off to large private corporations such as Capita, Southwest One and SERCO.

These articles leave little doubt about the extent of the FRAUD:

http://www.ukcolumn.org/article/section-151-officer-council-tax-and-fraudulent-accounting

http://www.ukcolumn.org/article/truth-about-raising-council-tax

MANY inhabitants of different areas will want to question their local councils about the FRAUD in the local area, hold individuals to account for their CRIMES and will want to enter 'Dispute' over any demands for payments of the PROVEN FRAUDULENT Council Tax.

What may also be of great concern to local inhabitants is the FACT that Malfeasance/Misconduct in Public Office has been committed, by definition in Law, and Misappropriation of Public Funds has led directly to cuts in services that have impacted upon the lives of so many, causing large numbers of suicides of people who believed that they 'owed' money to the CRIMINAL councils. In addition, council staff have been sworn to secrecy and given large conditional payouts to prevent them from telling the truth. There may be some council staff who are ignorant of the FRAUD by their employers, in which case they should be informed as soon as possible so that they can be held legally liable for any failure to report the FRAUD!

Council officers should be reminded that the CRIMINAL OFFENCE of Misconduct in Public Office carries with it a sentence of up to 14 years in prison!

EVERY council has huge sums in "investments", sums which are more than enough to negate the need for ANY payment of Council Tax and ANY need for cuts in services. This has been clearly established by investigations into the council financial reports and the fact that council Chief Financial Officers have been caught lying about the "reserves". Secrecy and Lies have been the 'normal practice' in ALL councils, especially since council administration was sold-off to large private corporations such as Capita, Southwest One and SERCO.

These articles leave little doubt about the extent of the FRAUD:

http://www.ukcolumn.org/article/section-151-officer-council-tax-and-fraudulent-accounting

http://www.ukcolumn.org/article/truth-about-raising-council-tax

MANY inhabitants of different areas will want to question their local councils about the FRAUD in the local area, hold individuals to account for their CRIMES and will want to enter 'Dispute' over any demands for payments of the PROVEN FRAUDULENT Council Tax.

What may also be of great concern to local inhabitants is the FACT that Malfeasance/Misconduct in Public Office has been committed, by definition in Law, and Misappropriation of Public Funds has led directly to cuts in services that have impacted upon the lives of so many, causing large numbers of suicides of people who believed that they 'owed' money to the CRIMINAL councils. In addition, council staff have been sworn to secrecy and given large conditional payouts to prevent them from telling the truth. There may be some council staff who are ignorant of the FRAUD by their employers, in which case they should be informed as soon as possible so that they can be held legally liable for any failure to report the FRAUD!

Council officers should be reminded that the CRIMINAL OFFENCE of Misconduct in Public Office carries with it a sentence of up to 14 years in prison!

Saturday 27 June 2015

All Councillors - it is a crime to pay Council Tax!

All Councillors - it is a crime to pay Council Tax!

The Law is quite clear on this matter - it is a CRIME under International and National Laws to support councils and their administrative corporations with payments that can be used, in any way. for funding wars and deaths of innocent civilians.

http://www.makewarshistory.co.uk/?p=1196

While it may be appropriate, in some cases, to pay a corporate council via their private-for-profit administrative corporation, in order to protect homes and other assets from CRIMINAL attempts at seizure (THEFT) by Third Party Interlopers, for the most part ANY payment of Council Tax can only be regarded as a CRIME according to established and ratified Law!

The Law is quite clear on this matter - it is a CRIME under International and National Laws to support councils and their administrative corporations with payments that can be used, in any way. for funding wars and deaths of innocent civilians.

http://www.makewarshistory.co.uk/?p=1196

While it may be appropriate, in some cases, to pay a corporate council via their private-for-profit administrative corporation, in order to protect homes and other assets from CRIMINAL attempts at seizure (THEFT) by Third Party Interlopers, for the most part ANY payment of Council Tax can only be regarded as a CRIME according to established and ratified Law!

Council Tax VICTORY the letter USED - a reminder!

"Council Tax victory the letter used"

This letter and administrative process achieved victory because it used the Law as it stands and in this man Dave's personal situation. The points of Law are absolute and can be applied by anyone!

https://www.youtube.com/watch?t=37&v=N2a91i3tzoc

(it is highly recommended that people copy the video and retain it on their computer for viewing offline and potentially reuploading to YT, in the event that it gets removed)

Council Tax is UNLAWFUL and FRAUDULENT. Council Tax is CORPORATE FRAUD and the Law is quite clear - there is NO LAW that requires non-commercial property owners/inhabitants to pay a single penny!

This letter and administrative process achieved victory because it used the Law as it stands and in this man Dave's personal situation. The points of Law are absolute and can be applied by anyone!

https://www.youtube.com/watch?t=37&v=N2a91i3tzoc

(it is highly recommended that people copy the video and retain it on their computer for viewing offline and potentially reuploading to YT, in the event that it gets removed)

Council Tax is UNLAWFUL and FRAUDULENT. Council Tax is CORPORATE FRAUD and the Law is quite clear - there is NO LAW that requires non-commercial property owners/inhabitants to pay a single penny!

Sunday 3 May 2015

Haringey Borough Council - ANOTHER 'rotten borough' - PROVEN!

High Court judge decides that Haringey council have been charging too much for their 'paperwork'. Harringey have been charging £125 for a £3 order!

http://www.nucleus.org.uk/test-case-in-the-high-court-on-liability-order-costs-april-30th-tottenham-vicar-challenges-lawfulness-of-council-tax-enforcement-costs/

http://www.haringeyindependent.co.uk/news/11519343.Vicar_emerges_triumphant_after_court_hearing/

http://www.independent.co.uk/news/uk/home-news/retired-vicar-who-refused-to-pay-council-tax-as-matter-of-principle-wins-high-court-victory-over-excessive-costs-10229437.html

It's time to STOP PAYING Council Tax to the Fraudulent & therefore Criminal councils!

http://www.nucleus.org.uk/test-case-in-the-high-court-on-liability-order-costs-april-30th-tottenham-vicar-challenges-lawfulness-of-council-tax-enforcement-costs/

http://www.haringeyindependent.co.uk/news/11519343.Vicar_emerges_triumphant_after_court_hearing/

http://www.independent.co.uk/news/uk/home-news/retired-vicar-who-refused-to-pay-council-tax-as-matter-of-principle-wins-high-court-victory-over-excessive-costs-10229437.html

It's time to STOP PAYING Council Tax to the Fraudulent & therefore Criminal councils!

Thursday 2 April 2015

Bournemouth Borough Council - ANOTHER 'Rotten Borough'!

Bournemouth Borough Council, as with councils across the country, Unlawfully & Illegally signed away the control of Public Assets, Public Funds and spending, pensions, investments, Council Tax & Business Rates collection, administration and enforcement, in 2010.

"At the stroke of a pen, four council departments and all the staff who worked within them were transferred from the council to Mouchel in 2010.

The 10-year outsourcing deal would create jobs, make massive savings and transform the way the council works, it was claimed.

But at the halfway point, the council has confirmed there has been little public scrutiny of the £150million deal because they have “not felt the need”."

http://www.bournemouthecho.co.uk/news/11810165._We_haven_t_felt_the_need_for_public_scrutiny_of___150m_Mouchel_deal____Bournemouth_councillors_speak_out/

Which means that Bournemouth Borough Council is a PRIVATE company! Which in turn means that ALL Council Tax (non-commercial/Domestic) is, by definition, subject to agreement/contract. This is by definition in Law and cannot be changed. Which means that ANY submission of accounts and 'agreement to pay' is the consent to contract. Without any return of completed accounts, without registration for the benefits, without agreement of liability (ie. accepting liability for the Legal Fictional title), there is NO LIABILITY to pay Council Tax!

http://truthproject.co.uk/BournemouthCouncil-Mouchel

Bournemouth folk will be concerned that a French private-for-profit company is 'creaming-off' large sums of precious Public Funds during a time of 'austerity' and cuts in Public Spending. Many will be concerned that this 'sale' of Public Administration amounts to the serious crime of Treason!

It turns out that Bournemouth Borough Council is no stranger to scandal.

"Adrian Fudge, a Lib Dem and former deputy council leader, accused the council of "playing with public money"."

http://www.bbc.co.uk/news/uk-england-dorset-18584998

All of which means that Bournemouth Borough Council is rotten to its core and should be replaced. Any councillors and council staff who took part in the signing-away of Bournemouth Borough Council's administration to Mouchel should be investigated and prosecuted for their criminal activities and should be forced to hand back ALL Public Funds that they have received in the last 5 years, including their private pensions!

"At the stroke of a pen, four council departments and all the staff who worked within them were transferred from the council to Mouchel in 2010.

The 10-year outsourcing deal would create jobs, make massive savings and transform the way the council works, it was claimed.

But at the halfway point, the council has confirmed there has been little public scrutiny of the £150million deal because they have “not felt the need”."

http://www.bournemouthecho.co.uk/news/11810165._We_haven_t_felt_the_need_for_public_scrutiny_of___150m_Mouchel_deal____Bournemouth_councillors_speak_out/

Which means that Bournemouth Borough Council is a PRIVATE company! Which in turn means that ALL Council Tax (non-commercial/Domestic) is, by definition, subject to agreement/contract. This is by definition in Law and cannot be changed. Which means that ANY submission of accounts and 'agreement to pay' is the consent to contract. Without any return of completed accounts, without registration for the benefits, without agreement of liability (ie. accepting liability for the Legal Fictional title), there is NO LIABILITY to pay Council Tax!

http://truthproject.co.uk/BournemouthCouncil-Mouchel

Bournemouth folk will be concerned that a French private-for-profit company is 'creaming-off' large sums of precious Public Funds during a time of 'austerity' and cuts in Public Spending. Many will be concerned that this 'sale' of Public Administration amounts to the serious crime of Treason!

It turns out that Bournemouth Borough Council is no stranger to scandal.

"Adrian Fudge, a Lib Dem and former deputy council leader, accused the council of "playing with public money"."

http://www.bbc.co.uk/news/uk-england-dorset-18584998

All of which means that Bournemouth Borough Council is rotten to its core and should be replaced. Any councillors and council staff who took part in the signing-away of Bournemouth Borough Council's administration to Mouchel should be investigated and prosecuted for their criminal activities and should be forced to hand back ALL Public Funds that they have received in the last 5 years, including their private pensions!

Wednesday 25 March 2015

Bristol City Council - ANOTHER 'Rotten Borough'!

Bristol City Council have been spending hundreds of thousands of pounds on their expenses.

http://www.dailymail.co.uk/news/article-3005115/Council-s-staff-spend-700-000-expenses-credit-cards-purchases-including-Ugg-Boots-iTunes-downloads-tattoo.html

With at least 30% of ALL Council Taxes going to private pensions, it really is time to STOP PAYING Council Tax!

"The cards

are intended for expenses including travel, office supplies and

catering. But thousands of pounds were spent on fast food, iTunes and

shopping trips abroad last year.

Throughout

2014, £1,860 a day was spent on Bristol City Council procurement cards,

figures obtained under the Freedom of Information Act show."

http://www.dailymail.co.uk/news/article-3005115/Council-s-staff-spend-700-000-expenses-credit-cards-purchases-including-Ugg-Boots-iTunes-downloads-tattoo.html

With at least 30% of ALL Council Taxes going to private pensions, it really is time to STOP PAYING Council Tax!

Wednesday 11 March 2015

Wirral Council admits that Council Tax is unlawful & sets a Legal Precedent

Wirral Council admits that Council Tax is unlawful & sets a Legal Precedent!

http://www.scribd.com/doc/37089298/WIRRAL-COUNCIL-Admits-That-Council-Tax-is-Unlawful-and-Sets-a-Legal-Precedent

There is NO DOUBT that a Legal Precedent has been set by this case some years ago!

Council Tax is illegal AND unlawful. It is FRAUD & DECEPTION. Those who attempt to enforce it, in ANY way, are guilty of Misconduct in Public Office and Misappropriation of Public Funds.

Therefore, paying Council Tax to ANY council is complicity in serious CRIMINAL offences liable to imprisonment!

http://www.scribd.com/doc/37089298/WIRRAL-COUNCIL-Admits-That-Council-Tax-is-Unlawful-and-Sets-a-Legal-Precedent

There is NO DOUBT that a Legal Precedent has been set by this case some years ago!

Council Tax is illegal AND unlawful. It is FRAUD & DECEPTION. Those who attempt to enforce it, in ANY way, are guilty of Misconduct in Public Office and Misappropriation of Public Funds.

Therefore, paying Council Tax to ANY council is complicity in serious CRIMINAL offences liable to imprisonment!

Monday 23 February 2015

Brentwood Borough Council - ANOTHER 'rotten borough'!

"Miss Ireland

was appointed temporary chief executive, juggling that job with her

other post. Her salary increased from £85,000 to £105,000 while

councillors hunted for a new chief executive.

After

months of delay, they have now announced that the top position will be

filled by Graham Farrant, the £185,000-a-year chief executive of

neighbouring Thurrock Borough Council.

He will continue at Thurrock in a job-share, with Brentwood paying Thurrock £42,000 a year for his part-time services.

Mr

Farrant is due to take up the job on March 1. After that Miss Ireland

will remain as Brentwood’s director of strategy and corporate services,

back on her old £85,000 salary, until a replacement is found for that

role."

http://www.dailymail.co.uk/news/article-2963332/Town-hall-chief-makes-105k-running-council-Essex-Cyprus-home-2-000-miles-away.html

Clearly it's 'jobs for the boys & girls' in Essex, at ANY COST, just as it is in Tory, Labour and LibDem councils around the country!

When the people of Essex discover that potentially MILLIONS of pounds of their precious Public Funds have been squandered and wasted on corporate-run LIES, they may choose to STOP PAYING Council Tax to the private-for-profit corporations that are ruining their county!

Sunday 22 February 2015

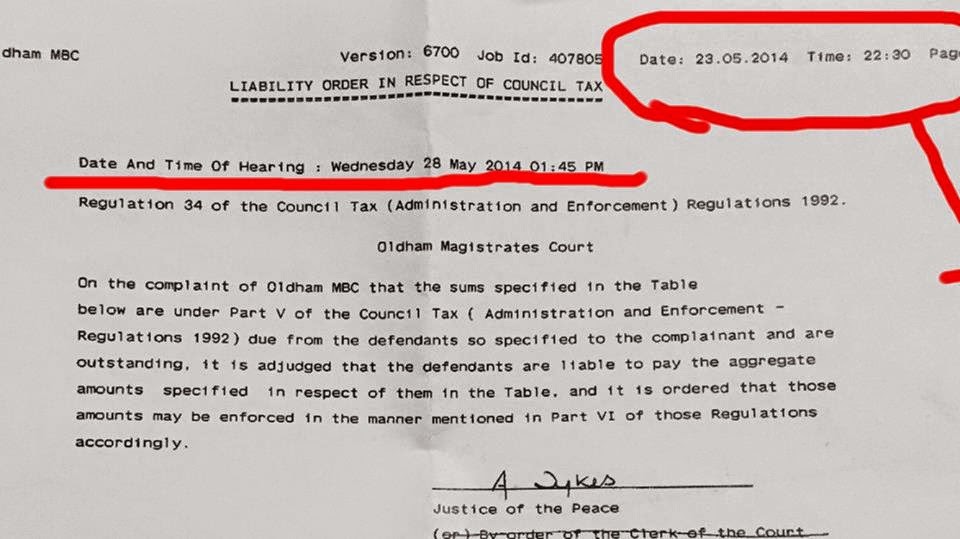

Oldham MBC - ANOTHER 'rotten borough'!

Oldham MBC, issues totally FRAUDULENT Liability Orders, thereby committing serious CRIMINAL offences!

When enough people STOP PAYING the FRAUDULENT Council Tax to the corporate councils the system will have to be scrapped. But equally importantly, the CRIMINALS must face prosecution for their CRIMES!

When enough people STOP PAYING the FRAUDULENT Council Tax to the corporate councils the system will have to be scrapped. But equally importantly, the CRIMINALS must face prosecution for their CRIMES!

End the Council Tax Summons Scam

End the Council Tax Summons Scam - e-petition

https://submissions.epetitions.direct.gov.uk/petitions/73677

Many thousands of people may wish to express their disgust at the rotten private-for-profit corporate councils and their collusion with the private-for-profit courts making millions from issuing summons!

https://submissions.epetitions.direct.gov.uk/petitions/73677

Many thousands of people may wish to express their disgust at the rotten private-for-profit corporate councils and their collusion with the private-for-profit courts making millions from issuing summons!

Sunday 8 February 2015

Harrogate Borough Council - ANOTHER 'rotten borough'!

Harrogate Borough Council and the £4-billion nationwide Council Tax SCANDAL

Legally speaking "Council Tax cannot be charged on Holiday Home Statics because Council Tax is payable only on Statics that are the Sole/Main Residences of the occupants."

However, "HBC has unlawfully charged a little over £10 million (58 x 174,000 = 10,092,000) over the past four years alone."

http://nyenquirer.uk/harrogate-council-4b-nationwide-council-scandal/

As we know, 30-50% of ALL Council Tax nationally goes to private council pensions, which is undeclared in the accounts submitted to each household, and councils are also using further amounts to pay vast expenses accounts, interest on debts, and are 'investing' large sums of Public Funds in attempts to get larger returns. Another substantial amount of local Public Funds has been spent on 'redundancy packages' and bribes to stop whistleblowers exposing the whole CRIMINAL & FRAUDULENT system!

When people know about the FRAUD it is their duty to expose it and to STOP PAYING Council Tax!

Millions of pounds lost every year due to 'Bedroom Tax'

Millions of pounds are being lost every year directly because of the discriminatory and unlawful FRAUDULENT Council Tax!

"Councils are losing £20million in rent a year as the disastrous Bedroom Tax leaves homes empty.

Nearly 1,500 multiple-bedroom properties are vacant because tenants cannot afford to move into them.

Under the Bedroom Tax their housing benefit has been slashed."

http://www.mirror.co.uk/news/uk-news/bedroom-tax-leaves-1500-larger-5124510

When enough people STOP PAYING the FRAUD of Council Tax and demand an open and Lawful system of paying for services that are actually provided, then the system will have to change!

"Councils are losing £20million in rent a year as the disastrous Bedroom Tax leaves homes empty.

Nearly 1,500 multiple-bedroom properties are vacant because tenants cannot afford to move into them.

Under the Bedroom Tax their housing benefit has been slashed."

http://www.mirror.co.uk/news/uk-news/bedroom-tax-leaves-1500-larger-5124510

When enough people STOP PAYING the FRAUD of Council Tax and demand an open and Lawful system of paying for services that are actually provided, then the system will have to change!

Tuesday 27 January 2015

Council Tax Challenge Part 1 Where is the evidence?

Council Tax Challenge Part 1 Where is the evidence?

"There is NO Law that a man or a women has to pay Council Tax. They issue this against your LEGAL FICTION which is not you."

https://www.youtube.com/watch?v=drY2aanCpLM

When a council addresses you as "Mr/Mrs/Miss/Ms" they are addressing the Legal Fiction, the 'person', which is a 'corporation', a 'corpse', something dead, a body with no living soul and no voice, subject to corporate 'rules & regulations'. They use the 'Capitus Maximus' system to get humans to admit being the Legal Fiction and thereby admit liability for the 'debts' of the 'person'. The title ("Mr/Ms...") denotes a position within a corporation. To force a human being to accept the title, the position, the liability, is the crime of "Enticement to Slavery" and anyone forcing this upon another is to be regarded as a dangerous criminal at large, whether from the police, bureaucracy, judiciary, or any other area of Public Service.

Further explanation can be found here:

http://www.yourstrawman.com/

Council Tax is a CORPORATE SCAM! There is NO law that says any domestic property is liable to pay it!

"There is NO Law that a man or a women has to pay Council Tax. They issue this against your LEGAL FICTION which is not you."

https://www.youtube.com/watch?v=drY2aanCpLM

When a council addresses you as "Mr/Mrs/Miss/Ms" they are addressing the Legal Fiction, the 'person', which is a 'corporation', a 'corpse', something dead, a body with no living soul and no voice, subject to corporate 'rules & regulations'. They use the 'Capitus Maximus' system to get humans to admit being the Legal Fiction and thereby admit liability for the 'debts' of the 'person'. The title ("Mr/Ms...") denotes a position within a corporation. To force a human being to accept the title, the position, the liability, is the crime of "Enticement to Slavery" and anyone forcing this upon another is to be regarded as a dangerous criminal at large, whether from the police, bureaucracy, judiciary, or any other area of Public Service.

Further explanation can be found here:

http://www.yourstrawman.com/

Council Tax is a CORPORATE SCAM! There is NO law that says any domestic property is liable to pay it!

Council Tax - ONLY if you have agreed to a service being provided!

Council Tax...........maybe we do not need to pay after all!

http://www.legislation.gov.uk/ukpga/2011/20/contents

164 Limits on charging in exercise of general power

(1) Subsection (2) applies where—

(a) 'a local authority provides a service to a person otherwise than for a commercial purpose', and

(b) 'its providing the service to the person is done, or could be done, in exercise of the general power'. 2) The general power confers power to charge the person for providing the service to the person only if—

(a) the service is not one that a statutory provision requires the authority to

provide to the person,

(b) the person has agreed to its being provided, and

(c) ignoring this section and section 93 of the Local Government Act 2003, the authority does not have power to charge for providing the service.

(3) The general power is subject to a duty to secure that, taking one financial year with another, the income from charges allowed by subsection (2) does not exceed the costs of provision.

(4) The duty under subsection (3) applies separately in relation to each kind of service.

165 Limits on doing things for commercial purpose in exercise of general

power

(1) The general power confers power on a local authority to do things for a

commercial purpose only if they are things which the authority may, in exercise of the general power, do otherwise than for a commercial purpose.

(2) Where, in exercise of the general power, a local authority does things for a commercial purpose, the authority must do them through a company.

(3) A local authority may not, in exercise of the general power, do things for a commercial purpose in relation to a person if a statutory provision requires the authority to do those things in relation to the person.

(4) In this section “company” means—(a) a company within the meaning given by section 1(1) of the Companies Act 2006, or (b) a society registered or deemed to be registered under the Co-operative and Community Benefit Societies and Credit Unions Act 1965 or the Industrial and Provident Societies Act (Northern Ireland) 1969.

Please read slowly and carefully..................

http://www.legislation.gov.uk/ukpga/2011/20/contents

164 Limits on charging in exercise of general power

(1) Subsection (2) applies where—

(a) 'a local authority provides a service to a person otherwise than for a commercial purpose', and

(b) 'its providing the service to the person is done, or could be done, in exercise of the general power'. 2) The general power confers power to charge the person for providing the service to the person only if—

(a) the service is not one that a statutory provision requires the authority to

provide to the person,

(b) the person has agreed to its being provided, and

(c) ignoring this section and section 93 of the Local Government Act 2003, the authority does not have power to charge for providing the service.

(3) The general power is subject to a duty to secure that, taking one financial year with another, the income from charges allowed by subsection (2) does not exceed the costs of provision.

(4) The duty under subsection (3) applies separately in relation to each kind of service.

165 Limits on doing things for commercial purpose in exercise of general

power

(1) The general power confers power on a local authority to do things for a

commercial purpose only if they are things which the authority may, in exercise of the general power, do otherwise than for a commercial purpose.

(2) Where, in exercise of the general power, a local authority does things for a commercial purpose, the authority must do them through a company.

(3) A local authority may not, in exercise of the general power, do things for a commercial purpose in relation to a person if a statutory provision requires the authority to do those things in relation to the person.

(4) In this section “company” means—(a) a company within the meaning given by section 1(1) of the Companies Act 2006, or (b) a society registered or deemed to be registered under the Co-operative and Community Benefit Societies and Credit Unions Act 1965 or the Industrial and Provident Societies Act (Northern Ireland) 1969.

Please read slowly and carefully..................

Subscribe to:

Posts (Atom)